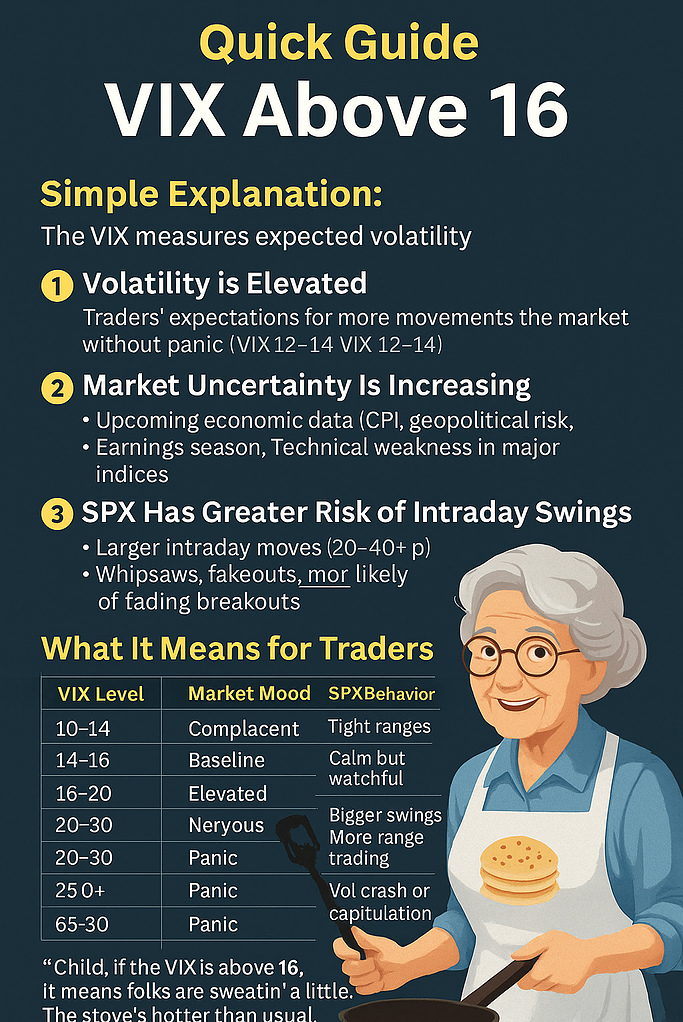

If the VIX (Volatility Index) is above 16, here’s what it generally means in practical trading terms — and how Grandma might put it:

🧠 Simple Explanation:

The VIX measures expected volatility in the S&P 500 over the next 30 days, based on option prices. When it’s above 16:

📈 1. Volatility is Elevated

- A VIX above 16 suggests that traders are pricing in more movement in the market.

- It’s not panic (like 30+), but it’s also not “calm and cozy” (like VIX 12–14).

⚠️ 2. Market Uncertainty Is Increasing

- This could be due to:

- Upcoming economic data (CPI, Fed, Jobs)

- Geopolitical risk

- Earnings season

- Technical weakness in major indices

📉 3. SPX Has Greater Risk of Intraday Swings

- You may see larger moves intraday (20–40+ pts).

- Whipsaws, fakeouts, and fading breakouts are more likely.

🔍 What It Means for Traders:

| VIX Level | Market Mood | SPX Behavior |

|---|---|---|

| 10–14 | Complacent | Tight ranges, grind up |

| 14–16 | Baseline | Calm but watchful |

| 16–20 | Elevated | Bigger swings, more range trading |

| 20–30 | Nervous | Trend breaks, selling pressure possible |

| 30+ | Panic | Vol crash or capitulation setups |

🧓 Grandma’s Version:

“Child, if the VIX is above 16, it means folks are sweatin’ a little. The stove’s hotter than usual. You better hold that spatula tight — ‘cause pancakes might fly.”

✅ What You Can Do:

- Avoid oversized trades — spreads get wider, risk increases.

- Expect traps — up moves may reverse quickly and vice versa.

- Watch support/resistance more closely — VIX >16 often causes more false breakouts.

IMPORTANT DISCLAIMER

This content is for educational purposes only and should not be considered financial advice. Trading involves substantial risk and may not be suitable for all investors. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any trading decisions. The author assumes no responsibility for any losses that may occur from following this information.