IKIGAI ALGO Series | Coffee With Q

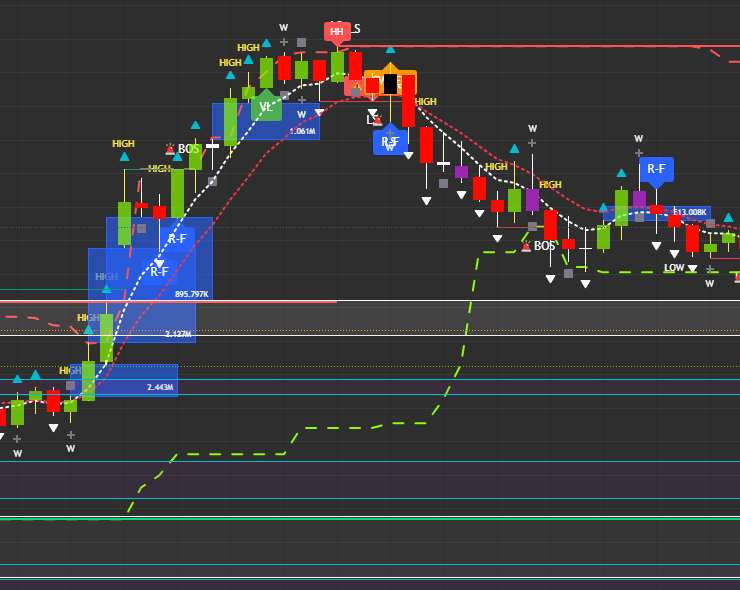

Welcome back to the IKIGAI ALGO series, brought to you by Coffee With Q! In Lab 2, we took a deep dive into combining Order Blocks (OBs) with our established POI (Point of Interest) Entry Rules for generating high-probability setups.

The goal? Achieving precision entry zones on the 5-Minute Chart using POI and OB with the IKIGAI Algo.

Let’s recap the core concepts and give you the ultimate cheat sheet for executing these advanced entries.

What is an Order Block (OB)?

Simply put, an Order Block is a zone where price paused before a big, decisive move. This is where smart money left “footprints,” and price often returns to these zones before continuing the trend.

On the chart, you’ll see: Colored boxes marking these zones, labeled as either NV (Not Valid) or VALID.

NV vs. VALID: The Traffic Light

Understanding the status of an OB is crucial:

| Status | Meaning | Action |

| NV (Not Valid) | Zone identified, NOT confirmed | WAIT |

| VALID | Price broke structure, zone confirmed | READY |

The Key Rule: “NV means NO. VALID means MAYBE. POI alignment means GO.”

The 2-Step Confirmation Process: OB + POI

A successful trade requires alignment between the Order Block and our Lab 1 POI rules.

Step 1: Order Block Status

• Is the OB marked VALID? • Is it in your trade direction? (BULL OB for longs, BEAR OB for shorts)

| Type | NV Color | Valid Color & Border |

| BULLISH OB | Yellow | Purple box, Aqua border |

| BEARISH OB | Grey | White box, White border |

Step 2: POI Alignment (Lab 1 Recap)

• Is the Dashboard (15/5/3) aligned? • Has price retraced to the red line? • Has the aqua arrow appeared?

If BOTH steps are confirmed, you have a GREEN LIGHT!

The Entry Sequence Cheat Sheet

| Element | LONG Setup (Bullish) | SHORT Setup (Bearish) |

| Structure | HH → HL pattern | LL → LH pattern |

| Order Block | BULL OB VALID (Purple) | BEAR OB VALID (White) |

| Dashboard (15/5/3) | All UP | All DOWN |

| Entry Trigger | Price INTO purple box | Price INTO white box |

| Final Signal | Aqua arrow → Enter | Aqua arrow → Enter |

When to STAY OUT

High-probability trading means knowing when to avoid a setup. When in doubt, STAY OUT.

NO TRADE Conditions:

✗ OB still marked NV (structure not confirmed) ✗ Dashboard not aligned (mixed signals 15/5/3) ✗ Price already deep inside OB (missed entry) ✗ OB already mitigated [M] (zone used up) ✗ Trading against HTF direction (fighting the trend) ✗ First 5 minutes of market open (let structure form) ✗ News event imminent (wait for dust to settle)

Final Thoughts

Mastering the POI + OB combination is the key to unlocking true precision entry zones. Keep practicing, keep checking your visual checklist, and trade safe!

Disclaimer

This material is provided by Coffee With Q, QAMAR ZAMAN and GARY P or its staff for educational discussion only. Nothing here constitutes financial, investment, or trading advice. Trading options, futures, and derivatives involve substantial risk of loss and may not be suitable for all investors. Past performance is not indicative of future results. Any opinions expressed are for illustration only and do not represent recommendations to buy or sell any security. Always consult a qualified financial advisor and read our full Terms & Risk Disclosure before engaging in trading activities.

IKIGAI ALGO • Coffee With Q • Educational Content Only