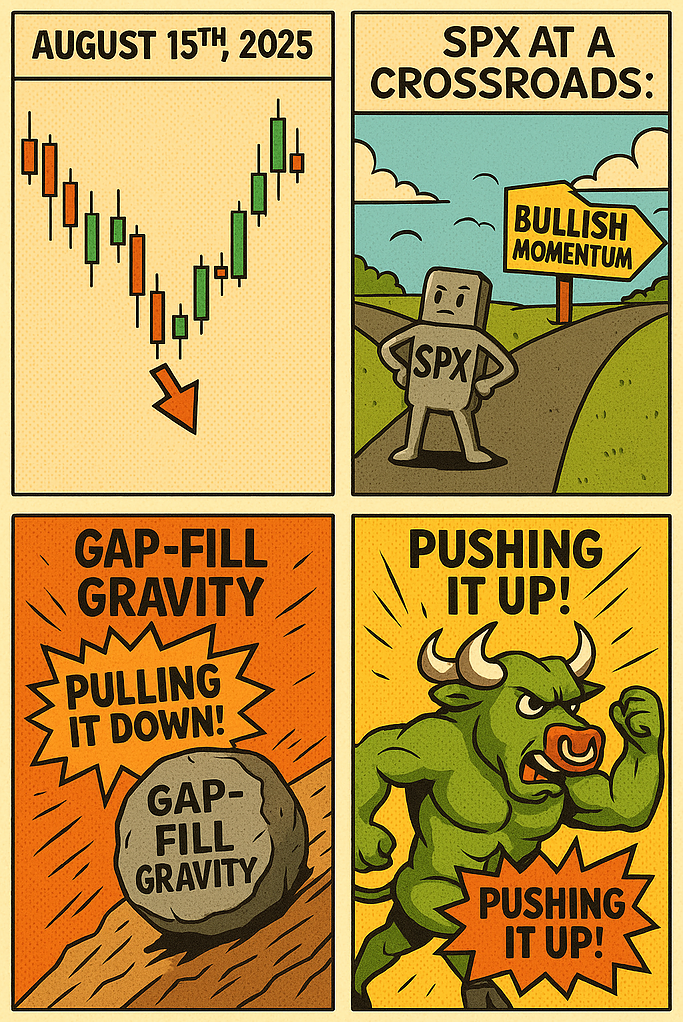

August 15th, 2025 – SPX at a Crossroads: Gap-Fill Gravity vs. Bullish Momentum

🌅 GRANDMA’S AM REPORT – AUGUST 15, 2025

Well good morning, sugar! Grandma’s got her coffee and fresh intel from the options pit…

KEEP YOUR EYES ON: The Big Money Tug-of-War!

Listen up, sweethearts – I just got the overnight institutional positioning data and holy moly, do they explain everything about this sideways mess we’ve been watching!

The Big Picture:

- 6450 = Massive Options Heavyweight Zone 📍

- 6500 = Another Monster Institutional Level 📍

- SPX at ~6468 = Stuck RIGHT in the middle like a pickle in a jar!

What This Means in Plain English: Big Daddy SPX has been caught between two giant walls of big money since Monday – that’s why we’ve had more chop than a lumberjack convention! When you’re trapped between the biggest institutional battle zones, the market makers keep yanking price back and forth like a dog toy.

Why Grandma’s Still Right:

- Bull breakout above 6500 still leads to 6507 → 6518 → 6528 (same plan!)

- Bear breakdown below 6450 confirms the 6435 → 6426 → 6410 path (told ya so!)

- But now we know WHY it’s been sideways – those gamma magnets have been arm-wrestling!

Today’s OPEX Game Plan: This expiration could finally break the spell. Watch for a decisive move above 6500 or below 6450 – either one should release the kraken and give us the directional move we’ve been waiting for.

Grandma’s Secret Pancake Indicator Update: My special yellow pancakes are looking a bit soggy this morning (small and flat), while the white pancakes aren’t exactly fluffy either. When those yellow pancakes start stacking up tall and golden, that’s when the bulls start dancing! When the white ones get thick as Sunday morning flapjacks, bears come out to play. Right now? We’re in that in-between breakfast zone where nobody knows if they want pancakes or waffles!

Remember: When elephants fight, the grass gets trampled. Today we find out which elephant wins – and what kind of pancakes we’re serving!

Now back to your regularly scheduled technical analysis…

Grandma’s Simple Guide: August 15th, 2025

Listen up, sweethearts! Grandma’s been watching this market longer than you’ve been alive. Here’s what the old lady sees:

With the S&P 500 Index trading around 6468 and options expiration looming tomorrow, we’re seeing a fascinating setup that could determine the market’s near-term direction. Analysis reveals a tug-of-war between unfilled technical gaps below and heavy put positioning that suggests traders are bracing for volatility.

The Gap Story: Inefficiencies Demanding Attention

Two unfilled fair value gaps are creating downside magnets that could pull price action lower:

- Lower Gap: 6287.28-6289.37

- Upper Gap: 6352.83-6355.22

These gaps represent areas where price moved too quickly, leaving behind inefficiencies that markets typically seek to fill. With the SPX currently trading nearly 100 points above the upper gap, there’s significant gravitational pull should the current bullish momentum show any signs of fatigue.

Options Positioning: A Put-Heavy Landscape

Tomorrow’s expiration data tells a compelling story of defensive positioning:

Volume Breakdown:

- Monthly Contracts: ~1.144M puts vs. ~614K calls

- Weekly Contracts: ~501K puts vs. ~180K calls

- Combined Put/Call Ratio: ~2.07

This 2-to-1 put dominance suggests traders are either hedging long positions or positioning for downside moves. The heavy put skew, combined with short gamma and positive vomma characteristics, creates conditions where volatility could spike dramatically if the market begins testing these gaps.

Critical Strike Levels: The Battleground

Resistance Zones (Call Heavy)

- 6500: The ultimate line in the sand – massive open interest suggests this level will either act as strong resistance or, if broken, could trigger significant upside acceleration

- 6490-6495: Secondary resistance cluster

- 6475: Key near-term resistance

- 6420: Notable for ~5,400 calls sold, indicating dealer hedging activity

Support Zones (Put Heavy)

- 6440: Primary pivot and support level

- 6435-6425: Secondary support cluster

- 6400: Psychological round number support

- 6350: Highest overnight put volume, strategically positioned near the upper fair value gap

The positioning at 6350 is particularly interesting – it aligns almost perfectly with the 6352-6355 gap, suggesting sophisticated traders are anticipating potential gap-fill activity.

The September Factor

Looking beyond tomorrow’s expiration, September positioning shows emerging interest around 6295 with open interest of ~5,629 contracts. This suggests longer-term traders are positioning for more significant downside potential, possibly targeting the lower fair value gap.

Tomorrow’s Outlook: Scenarios to Watch

Bearish Scenario

If selling pressure emerges and the SPX breaks below 6460-6475, watch for:

- Initial support test at 6440

- Potential cascade toward 6350 (gap-fill candidate)

- If 6350 fails, deeper decline toward 6295-6300 area

Bullish Scenario

For bulls to maintain control:

- Hold above 6460-6475 support zone

- Challenge and clear 6500 resistance

- Benefit from charm decay favoring calls if price stabilizes

Risk Management Considerations

The current setup presents elevated volatility risk. The combination of:

- Unfilled gaps below current price

- Heavy put positioning

- Short gamma environment

- Positive vomma skew

…creates conditions where small moves could amplify quickly. Traders should be prepared for potential volatility expansion, particularly if gap-filling begins.

Bottom Line

Tomorrow’s session presents a classic test between technical gaps seeking fulfillment and bullish momentum trying to maintain altitude. The put-heavy positioning suggests the market is braced for downside, but with critical resistance at 6500, we could see dramatic moves in either direction.

Key levels to monitor:

- Upside: 6500 breakout potential

- Downside: 6440 support, then 6350 gap-fill target

The market’s response to these levels will likely set the tone for the remainder of August. Stay alert for volatility expansion and manage risk accordingly.

Grandma’s Simple Guide: Best Bets for Tomorrow

Listen up, sweethearts! Grandma’s been watching this market longer than you’ve been alive. Here’s what the old lady sees:

3 Best Calls (Betting it Goes UP) 🚀

1. SPX 6500 Calls Why? This is the big kahuna, honey. If SPX breaks above 6500, it’s like opening the floodgates – all those nervous traders will have to buy, buy, buy! It’s the ultimate “I told you so” trade.

2. SPX 6475 Calls Why? This is your safety net call. If the market holds above here, those fancy Greeks (charm decay) start working in your favor. It’s like having the house odds on your side at the casino.

3. SPX 6490 Calls Why? The Goldilocks call – not too greedy, not too safe. If we get a push toward that 6500 resistance, these babies will pay handsomely without needing a miracle.

3 Best Puts (Betting it Goes DOWN) 📉

1. SPX 6350 Puts Why? This is where all the smart money is betting, right at that gap. It’s like knowing where the potholes are on your street – price wants to fill that hole something fierce!

2. SPX 6440 Puts Why? The first domino to fall. If this support level cracks, it’s going to be like a yard sale stampede – everybody rushing for the exits at once.

3. SPX 6400 Puts Why? Good old-fashioned round number psychology. People love their even numbers, and when 6400 breaks, it’s going to hurt feelings and wallets alike.

Grandma’s Final Word

Well butter my biscuit, this market’s got more drama than my soap operas! Big Daddy SPX is sitting up there at 6468, all puffed up and proud, but Grandma sees those gaps below just waiting to trip him up. It’s like watching your grandson try to impress the girls by walking on the fence – looks good until gravity reminds you who’s boss!

Tomorrow’s expiration has more puts than a mini golf course, so either folks are scared silly or they know something I don’t. Either way, Grandma’s got her reading glasses on and her coffee ready because this show’s about to get interesting.

Remember, sugar: Bulls make money, bears make money, but pigs get slaughtered – and right now, this market’s looking mighty bacon-worthy!

Keep your powder dry and your stops tighter than Grandma’s mason jar lids!

The Q Factor Blog provides quantitative analysis and market insights. This analysis is for educational purposes and should not be considered investment advice. Always conduct your own research and consult with financial professionals before making investment decisions.

LEGAL MUMBO JUMBO

Legal Disclaimer

Q Factor is developed and owned by [Your Company Name], a [Your State] LLC. This disclaimer applies to Q Factor, its website(s), and any other platforms where Q Factor software is distributed, promoted, or supported.

Trading Involves Risk

Trading financial instruments, including but not limited to stocks, options, futures, and cryptocurrencies, involves a high degree of risk and is not suitable for every investor. You should carefully consider whether trading is appropriate for your financial situation. Only risk capital should be used when trading.

Q Factor is a software tool designed to assist traders in analyzing market data, developing strategies, and managing trading decisions. It is not a trading signal service, brokerage, advisory service, or educational course. Q Factor does not execute trades on your behalf, provide individualized investment advice, or guarantee any trading results.

All outputs generated by Q Factor—such as indicators, analytics, strategy suggestions, or performance reports—are for informational and research purposes only and should not be construed as investment advice. The accuracy, completeness, and timeliness of data or analysis generated by Q Factor are not guaranteed. Any trading decisions you make based on information from Q Factor are made entirely at your own risk.

You are solely responsible for assessing the potential risks and consequences of your trading activities. Past performance, whether simulated or historical, is not necessarily indicative of future results.

Market Opinions Are Not Investment Advice

Any market commentary, forecasts, backtesting results, or strategy ideas generated or displayed by Q Factor are general market opinions and not specific investment recommendations. We accept no liability for any loss or damage, including but not limited to loss of capital or profit, that may arise directly or indirectly from the use of Q Factor or reliance on its outputs.

Technology & Internet Risks

Trading with the assistance of internet-connected software carries inherent risks, including but not limited to:

- Hardware or software failures

- Internet connectivity issues

- Data transmission delays

- System compatibility problems

Q Factor and its developers cannot control third-party data feeds, signal strength, or internet reliability, and therefore accept no responsibility for communication failures, errors, or delays in market data delivery.

U.S. Government Required Disclaimer – CFTC Rule 4.41

Futures and options trading has large potential rewards but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you cannot afford to lose. This software is neither a solicitation nor an offer to buy/sell futures, options, or any financial instruments. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Hypothetical or Simulated Performance Disclaimer: “HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. In fact, there are often sharp differences between hypothetical performance results and the actual results subsequently achieved by any trading program.”

Factors such as market volatility, emotional discipline, slippage, and order execution can significantly impact real trading results and cannot be fully accounted for in simulated performance.

This report is generated by Q Factor proprietary algorithms for informational purposes only. All analysis represents algorithmic processing of market data and should not be construed as investment advice. Users are responsible for their own trading decisions and risk management.

📰 Q ‘s Grandma’s Report – Market Tug-of-War – August 14, 2025

(Powered by Q Factor Algorithm – Verified by Grok)

📍 Where We Are Now

The market’s like a big see-saw today. On one side, the bulls (people betting prices will go up) are pushing, and on the other side, the bears (people betting prices will go down) are pushing back.

Right now, the see-saw is pretty balanced:

- ES Futures (S&P 500 Futures): ~6,484

- SPX Index (The S&P 500 itself): 6,466.58

- VIX (Fear Meter): 14.49 → Calm waters, not much panic.

📊 ES (S&P Futures) – A+ Setups

ES is like the “future ticket” for the S&P 500 — traders use it to guess where the market will be later.

| Setup Type | Price Level | What It Means | Where It Could Go Next |

| Pivot | 6,484 | The balance point — above this leans bullish, below this leans bearish. | N/A |

| A+ Long Door | Above 6,494 | Bulls might push higher if we get here. | 6,503 / 6,513 |

| A+ Short Door | Below 6,467 | Bears might take over here. | 6,460 / 6,454 |

| Risk Zone | Under 6,454 | Could tumble further. | 6,410 / 6,394 |

Grandma’s Note:

Above 6,494 → think “stairs going up.”

Below 6,467 → think “slide going down.”

📊 SPX (The S&P 500 Index) – Options Flow Snapshot

SPX is the “right now” version of the market. Options traders place bets at certain prices (called strikes). Big red bets are for down moves, big green bets are for up moves.

| Rank | Strike Price | Money at Stake | People Holding Bets | New Bets Today |

| #1 🔴 | 6,420 | $23.2M | 6,082 | 4,186 |

| #2 🔴 | 6,450 | $20.4M | 2,903 | 13,358 |

| #3 🟢 | 6,475 | $13.4M | 1,813 | 9,254 |

| #4 🟢 | 6,480 | $10.9M | 1,614 | 10,752 |

| #5 🔴 | 6,400 | $9.0M | 3,540 | 7,477 |

| #6 🟢 | 6,500 | $8.8M | 2,309 | 14,743 |

| #7 🔴 | 6,460 | $8.4M | 1,065 | 15,793 |

| #8 🔴 | 6,465 | $8.4M | 1,050 | 8,502 |

Legend: 🔴 = more puts (betting down) | 🟢 = more calls (betting up)

Grandma’s Note:

- Big money is bracing for a fight between 6,450 (downside) and 6,480–6,500 (upside).

- Think of those prices like tug-of-war knots in the rope — if one side pulls past it, they might keep going.

🎯 What This Means

Right now, the market is acting like a polite dance — a few steps up, a few steps down, nobody stepping on toes.

It’ll take a push above ES 6,494 / SPX 6,475 for the bulls to take the floor, or a drop under ES 6,467 / SPX 6,465 for the bears to cut in.

LEGAL MUMBO JUMBO

Legal Disclaimer

Q Factor is developed and owned by [Your Company Name], a [Your State] LLC. This disclaimer applies to Q Factor, its website(s), and any other platforms where Q Factor software is distributed, promoted, or supported.

Trading Involves Risk

Trading financial instruments, including but not limited to stocks, options, futures, and cryptocurrencies, involves a high degree of risk and is not suitable for every investor. You should carefully consider whether trading is appropriate for your financial situation. Only risk capital should be used when trading.

Q Factor is a software tool designed to assist traders in analyzing market data, developing strategies, and managing trading decisions. It is not a trading signal service, brokerage, advisory service, or educational course. Q Factor does not execute trades on your behalf, provide individualized investment advice, or guarantee any trading results.

All outputs generated by Q Factor—such as indicators, analytics, strategy suggestions, or performance reports—are for informational and research purposes only and should not be construed as investment advice. The accuracy, completeness, and timeliness of data or analysis generated by Q Factor are not guaranteed. Any trading decisions you make based on information from Q Factor are made entirely at your own risk.

You are solely responsible for assessing the potential risks and consequences of your trading activities. Past performance, whether simulated or historical, is not necessarily indicative of future results.

Market Opinions Are Not Investment Advice

Any market commentary, forecasts, backtesting results, or strategy ideas generated or displayed by Q Factor are general market opinions and not specific investment recommendations. We accept no liability for any loss or damage, including but not limited to loss of capital or profit, that may arise directly or indirectly from the use of Q Factor or reliance on its outputs.

Technology & Internet Risks

Trading with the assistance of internet-connected software carries inherent risks, including but not limited to:

- Hardware or software failures

- Internet connectivity issues

- Data transmission delays

- System compatibility problems

Q Factor and its developers cannot control third-party data feeds, signal strength, or internet reliability, and therefore accept no responsibility for communication failures, errors, or delays in market data delivery.

U.S. Government Required Disclaimer – CFTC Rule 4.41

Futures and options trading has large potential rewards but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you cannot afford to lose. This software is neither a solicitation nor an offer to buy/sell futures, options, or any financial instruments. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Hypothetical or Simulated Performance Disclaimer: “HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. In fact, there are often sharp differences between hypothetical performance results and the actual results subsequently achieved by any trading program.”

Factors such as market volatility, emotional discipline, slippage, and order execution can significantly impact real trading results and cannot be fully accounted for in simulated performance.

This report is generated by Q Factor proprietary algorithms for informational purposes only. All analysis represents algorithmic processing of market data and should not be construed as investment advice. Users are responsible for their own trading decisions and risk management.