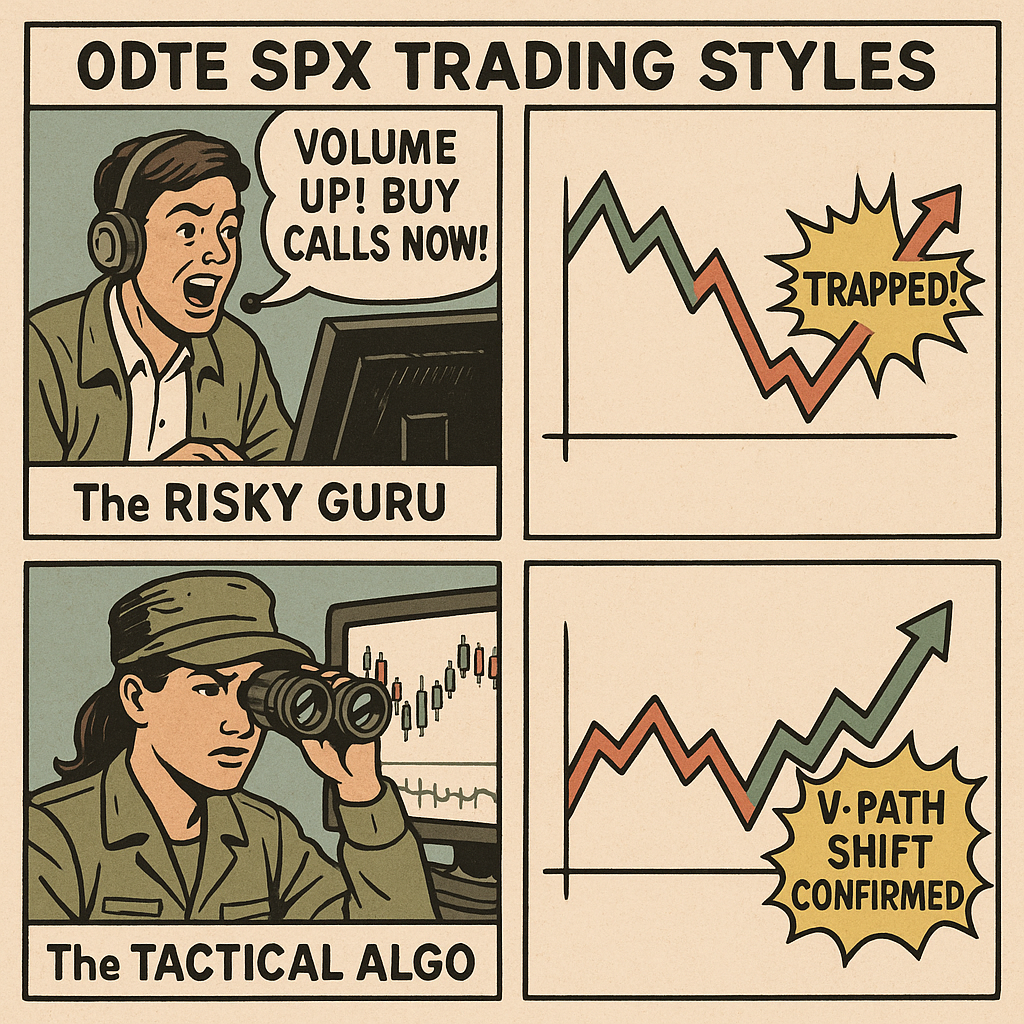

In the world of 0DTE SPX trading, some traders follow what I call the playbook — a style built on bold calls, fast reactions, and a loyal following, but often without the deep reconnaissance needed to avoid enemy traps. This isn’t about any single trader; it’s about a common approach that thrives on quick moves but often overlooks the bigger tactical picture. The Q FACTOR ALGO SPX ZERO DTE takes a different path…

TL;DR:

0DTE SPX options now represent nearly 48% of all SPX options volume and have increased fivefold over the last three years. In my experience, many self-styled SPX gurus promote quick profits with emotional calls, while the Q Factor FALCON STRIKE RECON system uses military-precision intelligence gathering to identify real opportunities versus enemy traps. This systematic approach, backed by verified signals and disciplined execution, consistently outperforms reactive, personality-driven trading.

The Rise of 0DTE SPX: A Battlefield Overview

Zero Days to Expiration (0DTE) options on the S&P 500 Index have become the ultimate high-speed trading battlefield. Between 2016 and 2023, 0DTE trading increased from 5% of total SPX options volume to 43%, creating a fast-paced environment where only disciplined tactical systems tend to survive.

SPX 0DTE options are cash-settled, eliminating assignment risk and making them well-suited for single buy/sell call and put strategies. Unlike those who react to every market twitch, successful 0DTE trading requires the precision of military reconnaissance.

Why “Guru-Style” SPX Trading Often Fails: The Rookie Pilot Problem

The Rookie’s Fatal Mistake

Lieutenant Jake “Hotshot” Miller represents the kind of trader who follows guru-style calls without independent verification. When his radio crackled with “Volume on the Profile going up – enemy forces retreating south!” Jake dove immediately, chasing what looked like easy money. But he went for a falling knife.

This is a classic market trap: smart money sets bait, and impulsive traders rush in. Because the guru-style approach chases discounted premium below a falling knife, it can lead traders into trouble.

The Guru-Style Trap

- Emotional Reactions: Immediate calls based on surface-level price action.

- No Deep Reconnaissance: Acting without verifying through multiple data points.

- False Confidence: Mistaking market noise for real opportunity.

- Herd Mentality: Following crowd momentum into liquidity traps.

From my observation, this is how many so-called SPX gurus operate:

- They react to market moves without comprehensive intelligence gathering.

- They often get caught in liquidity grab setups.

- They chase discounted premium without considering whether it’s bait.

- They treat falling knives as opportunities instead of traps.

The Q FALCON’s Tactical Advantage

Captain Sarah “Q Falcon” Rodriguez represents systematic 0DTE trading. She observed the same market action but held her position. Instead of reacting instantly, she monitored her LG detector carefully.

The FALCON STRIKE RECON Difference:

- Patience Under Fire: No immediate reactions to the obvious.

- Intelligence Gathering: Waiting for LG detection and V-signal confirmation.

- Tactical Discipline: Following tested rules regardless of emotions.

- Verified Strikes: Acting only on confirmed, high-probability signals.

When Sarah’s system finally showed V-PATH SHIFT CONFIRMED, she was perfectly positioned for the real market move — often in the opposite direction from where reactive traders had been caught.

The Q Factor FALCON STRIKE RECON System for 0DTE SPX

Liquidity Grabs (LG): The Enemy Trap Detection System

How Some Traders Fall for LG Traps:

Market: SPX spikes 5 points above resistance

Guru-Style Call: “BREAKING OUT! BUY CALLS NOW!”

Reality: LG trap – price immediately reverses

Result: Many traders lose money on the false signal

How Q FALCON Uses LG Intelligence:

Market: SPX spikes 5 points above resistance

Q System: “LG detected – potential false breakout”

Action: Wait for genuine V-signal confirmation

Result: Avoid trap, position for the real move

The Q Rule: Validation Before Execution

Invalid Signals (Guru-Style Territory)

- 🔴 Regular t-ALERT or PATH SHIFT: Basic movement with no deeper confirmation.

- 0DTE Action: WAIT — no trade without verification.

Valid Signals (Q FALCON Territory)

- 🟢 V-t-ALERT or V-PATH SHIFT: Confirmed breakthrough with Q Factor validation.

- 0DTE Action: EXECUTE — controlled, single trade entry.

Conclusion: Military Precision vs Reactive Chaos

The 0DTE SPX battlefield rewards systematic intelligence gathering over emotional reaction. From my perspective, the Q Factor FALCON STRIKE RECON system’s verified signals, enemy-trap detection, and disciplined execution offer a measurable advantage over personality-driven, spur-of-the-moment calls.

Operate like a Q FALCON pilot — gathering intel, waiting for confirmation, and striking with precision.

Stay sharp, stay tactical! 🫡

“Precision, Intelligence, Victory” – FALCON STRIKE COMMAND

⚠️ Q FACTOR DISCLAIMER

This newsletter is for educational and informational purposes only. It reflects the personal market views and trade logic of Q Factor — not financial advice, not investment guidance, and definitely not a promise of profits.

Trading futures, stocks, options, and other financial instruments involves serious risk. You can lose some, all, or more than your original investment. There are no guarantees in trading — only probabilities, execution, and discipline. Your account can and might go to zero. This is reality, not sales.

Q Factor is not a registered investment advisor, broker-dealer, or financial planner with the SEC, CFTC, or any other regulatory body. Nothing shared in this newsletter should be interpreted as a solicitation to buy or sell any securities or financial products. Always consult with a licensed financial professional before making trading decisions.

Any screenshots, price levels, or data mentioned are pulled from publicly available platforms — Q Factor has no affiliations with them. Market commentary may contain errors, misinterpretations, or reflect conditions that can change in a flash. That’s the nature of live markets.

The reader assumes full responsibility for any actions taken based on the content herein. You are in control. You are accountable.

All content shared in this newsletter is the intellectual property of Q Factor. Unauthorized use, copying, or redistribution — partial or full — is not allowed.

By reading this newsletter, you agree that you understand:

- This is for education only

- Risk belongs entirely to you

- Nothing here is personalized advice

- No guarantees are given or implied

Welcome to the grind. Manage risk. Be patient. Stay sharp.