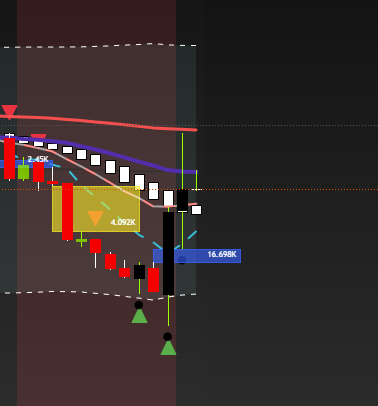

Impulse move with CLIMAX 11:44 am ET.

Date: Friday Edition

By: Qamar “Q” Zaman | Day Trader • Storyteller • Data Journalist

Subject: The art of catching a breakout before it goes nuclear 🚀

🧭 Morning Brew

Hey Traders,

Ever watched a stock creep sideways for days… then blast off like it just found caffeine? That’s not magic — that’s pressure building beneath the surface.

This week, I revisited an article by Roger Scott on The TradingPub titled “How to Identify Breakout Stocks.” It’s a solid foundation for understanding breakout setups — and today, I’ll show you how I blend that classic framework with a few modern tweaks from my private playbook (the “secret sauce” I only share with Grandma and my charts 😏).

☕ The Classic Breakout Recipe (Roger Scott’s Framework) – BTW- Uncle Roger is a Good Trader!

Roger highlights three timeless setups:

1️⃣ Inside Day Pattern – The Coiled Spring

- A trending stock pauses for 2–3 days where each candle is trapped inside the previous one.

- Think of it as a python coiling tighter — low volatility, high potential energy.

- When that range finally breaks, boom — you’re in early for the next leg.

2️⃣ Tail Gap Down – The Comeback Kid

- After a strong run, price gaps down briefly (creating a tail) and then snaps back fast in the trend’s direction.

- It’s a quick shakeout before the next rally — the market’s way of kicking off the weak hands.

3️⃣ The 52-Week High + Ascending Triangle – The Pressure Cooker

- A stock keeps testing resistance while printing higher lows, forming a triangle pattern.

- Add a nearby 52-week high, and you’ve got breakout fuel plus a healthy dose of FOMO ignition.

Bonus Wisdom: Always check sector strength and market context. A great setup in a weak market is just wasted caffeine.

🧪 Now… Here’s My Secret Sauce Upgrade (The Q Factor)

(Keep this between us — Grandma would revoke my cookie privileges if she knew I was spilling this much.)

💧 Liquidity + Volume Flow

I don’t just draw boxes — I map where institutions breathe. A true breakout begins where liquidity is trapped. When volume starts expanding through that zone, I know the big hands are unlocking the gate.

📈 Multi-Timeframe Confirmation

From the 15-minute down to the 1-minute — the story must align. If I see compression without intent, I stay flat. When the 1-minute candles tighten, volume dries up, and then one bold candle reclaims a zone… that’s my entry.

🧱 Zone Model + Order Blocks

Every breakout I trade starts from a zone — not a line. I track the previous day’s high/low, liquidity gaps (aka QZ Black Swan Zones), and institutional footprints. Price must tag, react, and reclaim before I move.

🕒 Session Timing = The Real Edge

Breakouts that trigger during my execution windows (9:30–12:00 and 3:30–4:00) often lead to high-energy scalps. Midday moves? Usually fugazi.

💰 Option Overlay

When trading SPX or SPY options on a breakout, I watch implied volatility like a hawk. I want quiet premiums — not inflated ones. I buy the strike nearest the breakout and target a fast 20–25% pump.

🎯 How I Identified This Week’s Breakout

While everyone else watched the chop, my chart whispered:

- Liquidity building just below resistance

- Volume contraction tightening the coil

- One sneaky liquidity sweep — the “Grandma Trap”

- Then a reclaim with volume expansion — my green light

That’s where I entered: one tick from my zone, clean separation between my mid-band and the 80 SMA.

The rest? Let’s just say it covered my next espresso run. ☕💵

💬 Takeaway for Traders

Breakouts don’t shout — they whisper.

When you combine structure (Roger’s framework) with flow intelligence (my secret sauce), you stop chasing and start anticipating.

Breakouts = Patience + Context + Timing.

Trade the move before the crowd realizes it’s happening.

📊 my SPX Trade OCT 31st, 2025

Caption: “When compression met conviction — the zone spoke, and I listened.”

⚠️ Disclaimer

This newsletter is for educational and informational purposes only. Nothing herein constitutes financial, legal, or investment advice. Trading options and stocks involves significant risk and may result in loss of capital. Always conduct your own due diligence and trade responsibly.

Follow Coffee With Q for daily market psychology, breakout setups, and storytelling that connects data to human behavior.