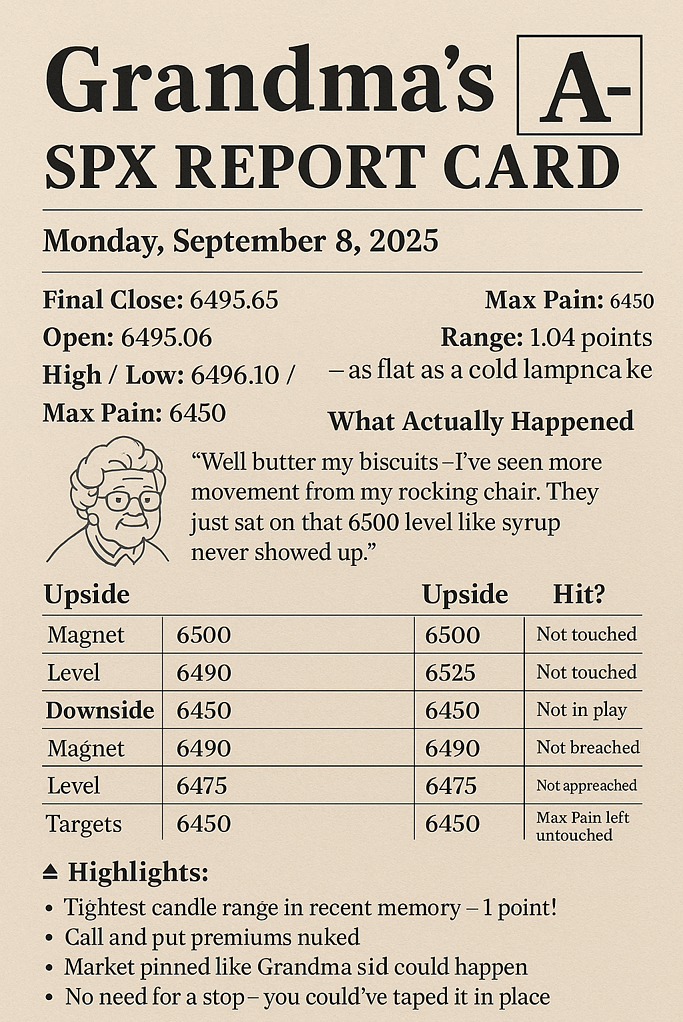

📅 Date: Monday, September 8, 2025

📈 Final Close: 6495.15

📊 Change: +13.65 (+0.21%)

📍 Max Pain: 6450

🎯 Day’s Bias: Slow grind up — pinned under control zones

🥞 Quote of the Day:

“This one didn’t cook too fast, sugar. We hovered just below the syrup stack — 6500 stayed warm, but not flipped.”

📊 Where Did SPX Go?

- ✅ Opened near 6502

- ✅ Hovered around 6500, but never broke out cleanly

- ✅ Stayed inside Friday’s upper zone (6520 stretch never tested)

- ✅ Never broke below D1 (6490) — solid hold

- ❌ Didn’t press higher into M2/M3

📈 Forecast Review: How Grandma Did

🔼 Upside Targets

| Magnet | Level | Hit? | Notes |

| M1 | 6500 | ✅ | Hovered all day but never broke through |

| M2 | 6520 | ❌ | Not tested |

| M3 | 6525 | ❌ | No momentum to chase |

🔽 Downside Targets

| Magnet | Level | Hit? | Notes |

| D1 | 6490 | ✅ | Tested and held support |

| D2 | 6475 | ❌ | Never dipped low enough |

| D3 | 6450 | ❌ | Max Pain remained untouched |

💡 Highlights:

- Price consolidated under 6500, acting like a lid

- 6490 served as firm intraday support

- Very controlled session, suggesting market was in balance mode

- Call decay likely while puts didn’t get paid

🎓 Final Grade: B+

✅ Correctly identified 6500 magnet

✅ D1 (6490) support worked beautifully

❌ No test of 6520 stretch or pull to 6450

🔄 Market stayed in the middle, respecting Grandma’s range

IMPORTANT DISCLAIMER

This content is for educational purposes only and should not be considered financial advice. Trading involves substantial risk and may not be suitable for all investors. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any trading decisions. The author assumes no responsibility for any losses that may occur from following this information.