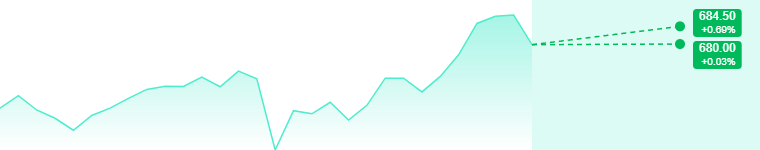

SPX Close: 6,827 SPY Close: 682.7

Data Driven Insights – NOT A FINANCIAL ADVICE — See Disclaimer

🎯 SPX Key Levels

- CALL Zone (Above 6,850):

If SPX breaks and holds above 6,850 → buy CALLS toward 6,875 → 6,900.

⚡ Momentum pickup if volume increases around 6,860+. - PUT Zone (Below 6,800):

If SPX drops under 6,800 → buy PUTS toward 6,775 → 6,750.

🩸 Quick flush zone if selling accelerates. - Range Zone (6,800–6,850):

Expect sideways action and fake breakouts — scalp edges, don’t chase.

🎯 SPY Key Levels

- CALL Zone (Above 685):

If SPY holds above 685 → buy CALLS toward 687 → 689. - PUT Zone (Below 681):

If SPY breaks below 681 → buy PUTS for a quick flush to 678–676. - Range Zone (681–685):

Low energy zone — fade edges or stay flat until a clear break.

👵 Grandma’s Bias (Based on Data, Not Feelings)

“The market’s sitting on a fence again. Whoever jumps first gets the cookies.”

- Above 6,850 / 685 → Bulls run the show.

- Below 6,800 / 681 → Bears take control.

- Between → Expect chop, noise, and market maker games.

📊 Quick Game Plan

| Asset | Trigger | Bias | Trade | Target | Stop |

| SPX | > 6,850 | Bull | CALL | 6,875 – 6,900 | < 6,840 |

| SPX | < 6,800 | Bear | PUT | 6,775 – 6,750 | > 6,810 |

| SPY | > 685 | Bull | CALL | 687 – 689 | < 684 |

| SPY | < 681 | Bear | PUT | 678 – 676 | > 682 |

🧭 Grandma’s Takeaway

- Both SPX and SPY are parked just below their “go” levels.

- A clean break above SPX 6,850 / SPY 685 = momentum to the upside.

- Slip under SPX 6,800 / SPY 681 = expect a quick slide before buyers return.

⚠️ Disclaimer

This analysis is based on options positioning (OI + Volume) and dealer zones for SPX & SPY.

It is not financial advice. Always confirm with live price action and use tight risk management.