This tool is your MBA in volume data analysis.

By Qamar Zaman | Coffee With Q

The Market Told the Story. Most Traders Didn’t Listen.

December 30th, 2025. The last trading days of the year. Low volume. Holiday markets. The perfect hunting ground for Smart Money.

While most retail traders were either on vacation or trading blind, my Q ALGO 9 was reading the footprints they left behind.

And it told the entire story.

What Is Q ALGO 9?

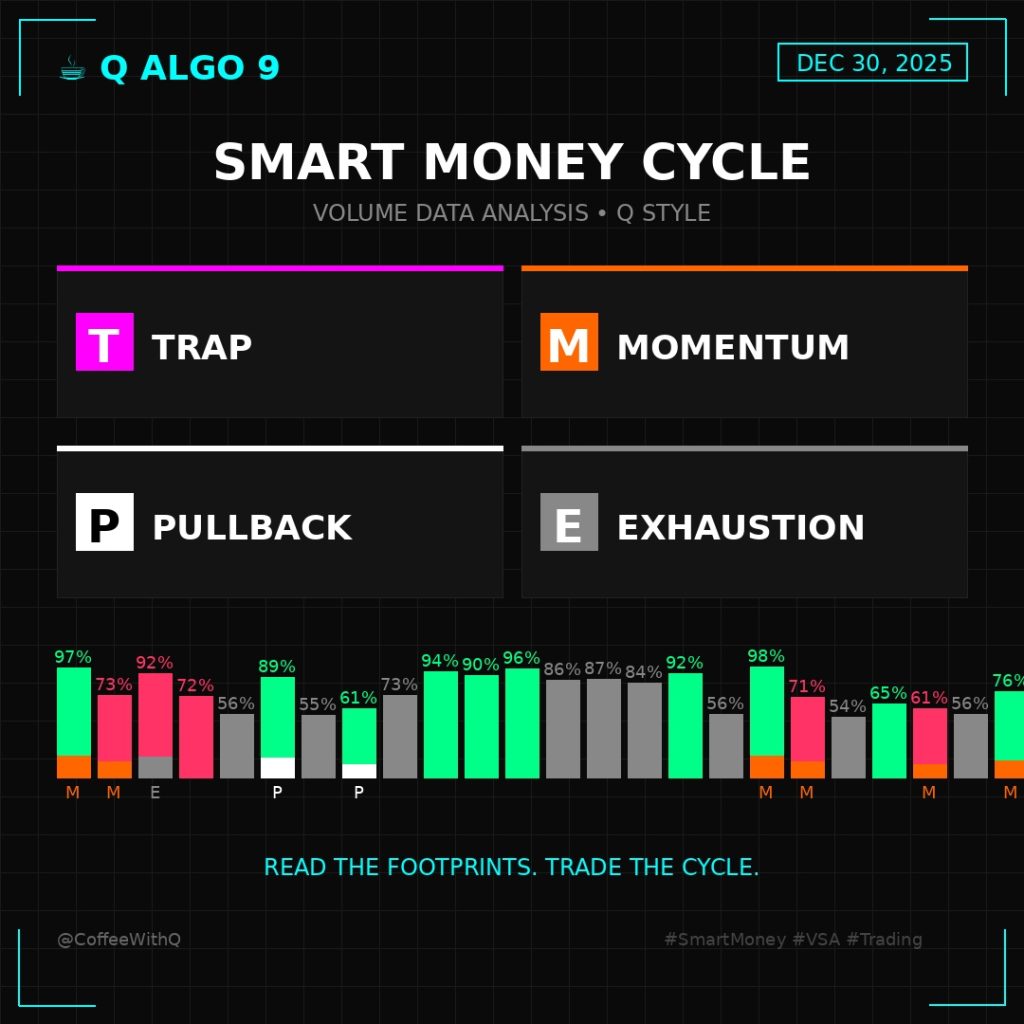

Q ALGO 9 is a Volume Spread Analysis (VSA) indicator I built to detect the four phases of the Smart Money Cycle:

| Signal | What It Means |

| 🪤 TRAP (Purple) | They’re absorbing orders and trapping retail. |

| 🚀 MOMENTUM (Orange) | Smart Money is pushing price. |

| ↩️ PULLBACK (White) | Healthy pullback or liquidity sweep. Weak hands shaken out. |

| ⚠️ EXHAUSTION (Grey) | Reversal warning. Smart Money is exiting. |

December 30th: The Data Tells the Story

No lagging indicators. No complicated oscillators. Just pure volume and price spread analysis—the way Wyckoff intended.

Look at the chart. Here’s what Q ALGO 9 showed:

Morning Session: The Setup

The day started with multiple MOMENTUM (M) signals firing on orange bars. Volume was elevated. Spreads were wide. Smart Money was making moves.

The stacked bars showed the story:

- 94% sellers on a big red bar

- 100% buyers stepping in at a key level

- Clear transitions between buyer and seller dominance

The Key Observation

Notice how the M signals clustered during the trending moves. That’s not random. That’s Smart Money pushing price in their intended direction with conviction.

When you see:

- High volume ✓

- Wide spread ✓

- Clear buyer/seller dominance ✓

That’s MOMENTUM. That’s when you ride the wave.

The Exhaustion Warning

Later in the session, the system started showing exhaustion.

What does that mean?

Smart Money is stepping back. The move is running out of fuel. Time to be cautious.

The Four Phases in Action

Here’s how the Smart Money Cycle played out on December 30th:

Why This Matters

Most traders are looking at RSI, MACD, moving averages—all lagging indicators that tell you what already happened.

Q ALGO 9 shows you what’s happening RIGHT NOW:

- Who’s in control (buyers or sellers)?

- What type of volume is this (trap, momentum, pullback, exhaustion)?

- Is Smart Money loading or unloading?

The stacked bar design makes it visual:

- Top portion: Green for buyers, Red for sellers

- Bottom portion: Purple/Orange/White/Grey for signal type

- Percentage labels: Exact buyer/seller dominance

One glance. Complete picture.

Learn to Read the Footprints

I’m not here to give you signals. I’m not here to tell you when to buy or sell.

I’m here to teach you how to READ the market.https://www.coffeewithq.org/gp/

Smart Money leaves footprints every single day. The TRAP. The MOMENTUM. The PULLBACK. The EXHAUSTION. They repeat this cycle over and over.

Once you learn to see it, you can’t unsee it.

Q ALGO 9 is my tool for making those footprints visible. The data is there. The patterns are there. You just need to learn how to interpret them.

The Bottom Line

December 30th wasn’t random. The moves weren’t unpredictable. Smart Money told the story through volume and spread.

Q ALGO 9 translated that story into four simple signals.

If you want to stop being the exit liquidity and start being on the right side of these moves, you need to understand the Smart Money Cycle.

Coffee With Q. Where we decode the market together.

— Q

Disclaimer

This is not investment advice. I’m not calling trades. I’m showing you data.

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Q ALGO 9 and any associated indicators, tools, or educational materials are provided for informational and educational purposes only and do not constitute financial, investment, or trading advice. You should consult with a qualified financial advisor before making any trading decisions. Q Levels and affiliated parties are not registered investment advisors, broker-dealers, or financial planners. By participating in any educational program, you acknowledge that you are solely responsible for your own trading decisions and any resulting gains or losses. No guarantees of profit or specific results are made or implied. Please trade responsibly and only risk capital you can afford to lose.