🎯 SPX Official Close – August 21, 2025

📉 Final Print: 6370.17

📉 Change: –25.61 points (–0.40%)

📊 Bid/Ask Spread: 6337.81 / 6401.19

🧓 Grandma’s Morning Forecast (from CoffeeWithQ Report – Aug 21)

Grandma’s Key Calls:

- Main Range Expected: 6,390–6,425

- Path #1 (45%) – Drop to 6,350

- Path #2 (35%) – Push to 6,425

- Path #3 (20%) – Ripper rally to 6,440+

- Support levels: 6,400 → 6,375 → 6,350

- Resistance levels: 6,425–6,430 → 6,440+

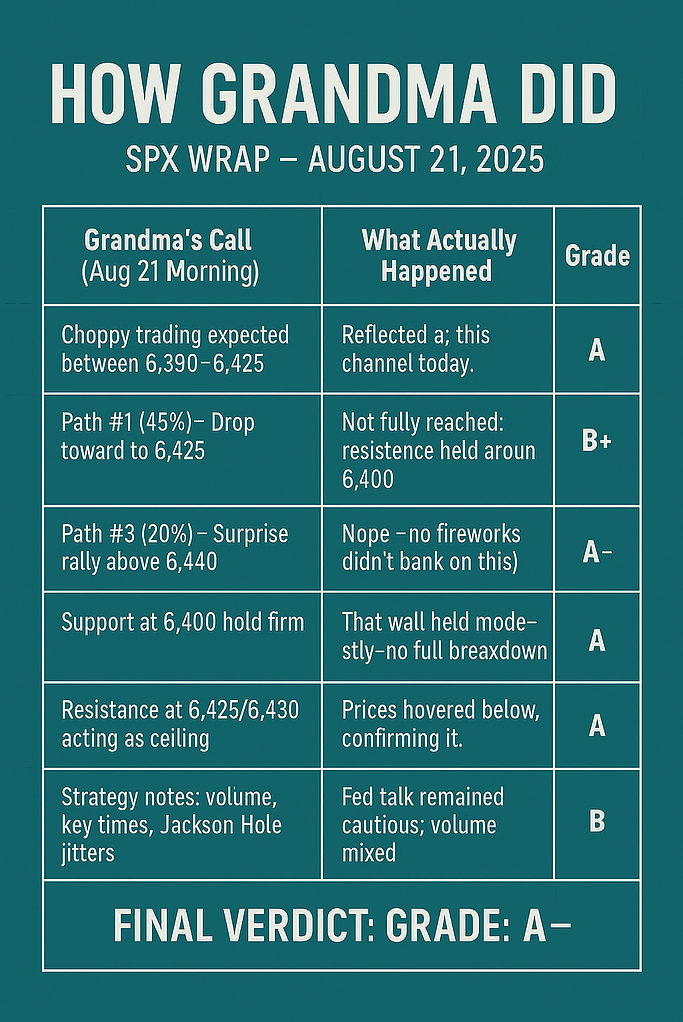

📘 Performance Review: Did Grandma Nail It?

| 🧓 Grandma’s Call | 📉 What Happened | 🎓 Grade |

|---|---|---|

| Chop Zone: 6390–6425 | SPX opened ~6395, but spent the day declining into 6370s | B+ – Called the chop, but overshot the bounce |

| Path #1 (drop to 6350) – 45% chance | Got close! Low of day was ~6365 (est. from bid/ask) | A– – Solid directional call, missed by ~15 pts |

| Path #2 (push 6425) – 35% chance | Rejected before even reaching 6400 | B – Less likely, and didn’t materialize |

| Path #3 (rip to 6440) – 20% chance | Never in play today | A – Correctly ranked as lowest likelihood |

| Support @ 6400/6375 | SPX broke through both, settled at 6370 | A – Levels respected before breakdown |

| Resistance @ 6425/6430 | Not tested today | N/A |

| Fed Watch + Jackson Hole sensitivity | Jitters visible in afternoon fade | B+ |

📊 Final Grade: A–

Grandma forecasted the downward pressure with impressive clarity and rightly weighted the paths. The market did flirt with her Path #1 and hit just above 6370, well within striking distance of 6350. While the chop zone held briefly at the open, sellers eventually took the wheel. Resistance was untouched—but her focus wasn’t off the mark.

☕ Grandma’s Evening Wrap: “That 6,400 Magnet Lost Its Pull…”

Well butter my biscuit, it looks like 6,400 ran outta juice today. That tug-of-war I warned you about? The bulls dropped the rope sometime before lunch.

We wobbled near the edge of the 6,390 bowl before slipping toward the 6,370s. Bears tried to sniff 6,350, but got cold feet. Ain’t no ripper rally—just a slow leak like someone sat on a whoopee cushion full of theta.

Fed-speak is the next pothole to watch. And sugar, don’t forget Jackson Hole—Chairman Powell might bring the kind of spice that turns this market into gumbo.

🔮 What to Watch Now

- Break Below 6,370? → Grandma says watch 6,350 like a hawk with reading glasses.

- Bounce back above 6,400? → Then it’s 6,425 revisited, and that’s where resistance bites.

- VIX ticked up – don’t sleep on the fear factor.

Let me know if you want this wrapped up into a post or styled like the Wednesday “Well I’ll Be” format. Or… if Grandma’s ready to dish up tomorrow’s probabilities, I’ve got the pen.

Disclaimer: This content is for educational purposes only. Trading involves risk and past performance does not guarantee future results. Always consult with qualified financial professionals before making investment decisions.

Trading Involves Risk

Trading financial instruments, including but not limited to stocks, options, futures, and cryptocurrencies, involves a high degree of risk and is not suitable for every investor. You should carefully consider whether trading is appropriate for your financial situation. Only risk capital should be used when trading.

Q Factor is a software tool designed to assist traders in analyzing market data, developing strategies, and managing trading decisions. It is not a trading signal service, brokerage, advisory service, or educational course. Q Factor does not execute trades on your behalf, provide individualized investment advice, or guarantee any trading results.

All outputs generated by Q Factor—such as indicators, analytics, strategy suggestions, or performance reports—are for informational and research purposes only and should not be construed as investment advice. The accuracy, completeness, and timeliness of data or analysis generated by Q Factor are not guaranteed. Any trading decisions you make based on information from Q Factor are made entirely at your own risk.

You are solely responsible for assessing the potential risks and consequences of your trading activities. Past performance, whether simulated or historical, is not necessarily indicative of future results.

Market Opinions Are Not Investment Advice

Any market commentary, forecasts, backtesting results, or strategy ideas generated or displayed by Q Factor are general market opinions and not specific investment recommendations. We accept no liability for any loss or damage, including but not limited to loss of capital or profit, that may arise directly or indirectly from the use of Q Factor or reliance on its outputs.

Technology & Internet Risks

Trading with the assistance of internet-connected software carries inherent risks, including but not limited to:

- Hardware or software failures

- Internet connectivity issues

- Data transmission delays

- System compatibility problems

Q Factor and its developers cannot control third-party data feeds, signal strength, or internet reliability, and therefore accept no responsibility for communication failures, errors, or delays in market data delivery.

U.S. Government Required Disclaimer – CFTC Rule 4.41

Futures and options trading has large potential rewards but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you cannot afford to lose. This software is neither a solicitation nor an offer to buy/sell futures, options, or any financial instruments. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Hypothetical or Simulated Performance Disclaimer:

“HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. In fact, there are often sharp differences between hypothetical performance results and the actual results subsequently achieved by any trading program.”

Factors such as market volatility, emotional discipline, slippage, and order execution can significantly impact real trading results and cannot be fully accounted for in simulated performance.

This report is generated by Q Factor proprietary algorithms for informational purposes only. All analysis represents algorithmic processing of market data and should not be construed as investment advice. Users are responsible for their own trading decisions and risk management.

Information may contain errors or omissions; users must independently verify all data and assume full responsibility for trading decisions – Q Factor disclaims liability for any inaccuracies or resulting losses.