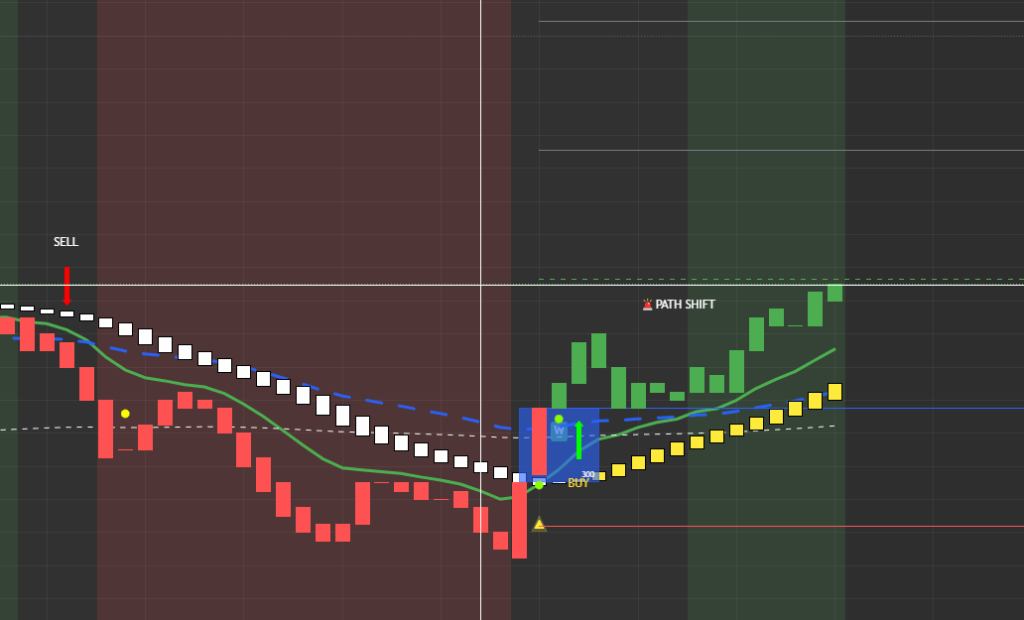

6420 is the pivot to watch. Failed breakdowns near 6420 or 6410–6408 favor longs; rejection at 6461 favors shorts.

The latest Coffee With Q trade outlook for Wednesday highlights 6420 on the S&P 500 futures (ES) as the critical intraday pivot level for traders.

After spending a full week consolidating between 6500 and 6460, ES broke down from that range on Tuesday. This shift puts short-term control in the hands of bears unless buyers reclaim 6461. Despite this short-term weakness, higher timeframes still show bulls firmly in charge.

Long Setups

Traders watching for buy opportunities may find A+ entries at:

- 6420–6419: Failed Breakdown of Tuesday’s low

- 6410–6408: Flush and recovery zone

- 6403–6387: Stronger support, best if undercut and reclaimed

- 6436–39: Reclaim and hold, targeting 6450–6461

Short Setups

For advanced traders only, A+ short entries include:

- 6461 back-test: First fresh retest of breakdown, higher probability short

- 6420 breakdown: Clean failure of support opens targets at 6408, 6403, and 6387

Trade Flow

- Above 6461: Bulls regain control, aiming for 6474–6492–6503

- Below 6420: Bears press lower, with downside targets at 6408–6387

- Between 6420–6460: Expect chop; trade only clear failed breakdowns or reclaim setups

Wisdom for Traders

The Coffee With Q trade plan reminds traders:

- Avoid guessing — let price confirm first.

- Take profits quickly and reset bias level by level.

- Failed Breakdowns often provide the highest-quality long entries.

- Breakdown shorts carry lower win rates and should be attempted only by experienced traders.

One-Line Summary

Source: Q ALGO

Published by: Coffee With Q Podcast News

📧 digital@kisspr.com

🌐 www.coffeewithq.org

Watch the Complete Tutorial: Coffee with Q Podcast: Trading Insights with Qamar Zaman

Disclaimer: This content is for educational purposes only. Trading involves risk and past performance does not guarantee future results. Always consult with qualified financial professionals before making investment decisions.

Trading Involves Risk

Trading financial instruments, including but not limited to stocks, options, futures, and cryptocurrencies, involves a high degree of risk and is not suitable for every investor. You should carefully consider whether trading is appropriate for your financial situation. Only risk capital should be used when trading.

Q Factor is a software tool designed to assist traders in analyzing market data, developing strategies, and managing trading decisions. It is not a trading signal service, brokerage, advisory service, or educational course. Q Factor does not execute trades on your behalf, provide individualized investment advice, or guarantee any trading results.

All outputs generated by Q Factor—such as indicators, analytics, strategy suggestions, or performance reports—are for informational and research purposes only and should not be construed as investment advice. The accuracy, completeness, and timeliness of data or analysis generated by Q Factor are not guaranteed. Any trading decisions you make based on information from Q Factor are made entirely at your own risk.

You are solely responsible for assessing the potential risks and consequences of your trading activities. Past performance, whether simulated or historical, is not necessarily indicative of future results.

Market Opinions Are Not Investment Advice

Any market commentary, forecasts, backtesting results, or strategy ideas generated or displayed by Q Factor are general market opinions and not specific investment recommendations. We accept no liability for any loss or damage, including but not limited to loss of capital or profit, that may arise directly or indirectly from the use of Q Factor or reliance on its outputs.

Technology & Internet Risks

Trading with the assistance of internet-connected software carries inherent risks, including but not limited to:

- Hardware or software failures

- Internet connectivity issues

- Data transmission delays

- System compatibility problems

Q Factor and its developers cannot control third-party data feeds, signal strength, or internet reliability, and therefore accept no responsibility for communication failures, errors, or delays in market data delivery.

U.S. Government Required Disclaimer – CFTC Rule 4.41

Futures and options trading has large potential rewards but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you cannot afford to lose. This software is neither a solicitation nor an offer to buy/sell futures, options, or any financial instruments. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Hypothetical or Simulated Performance Disclaimer:

“HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. In fact, there are often sharp differences between hypothetical performance results and the actual results subsequently achieved by any trading program.”

Factors such as market volatility, emotional discipline, slippage, and order execution can significantly impact real trading results and cannot be fully accounted for in simulated performance.

This report is generated by Q Factor proprietary algorithms for informational purposes only. All analysis represents algorithmic processing of market data and should not be construed as investment advice. Users are responsible for their own trading decisions and risk management.

Information may contain errors or omissions; users must independently verify all data and assume full responsibility for trading decisions – Q Factor disclaims liability for any inaccuracies or resulting losses.