Coffee With Q – Simple Market Summary

Top Levels to Watch With Q ALGO

Today’s Probable Setup

Yesterday’s Close: 6,406.62 (-0.61%)

Today’s Mission: Market decides direction while Jackson Hole meeting starts

Today’s Game Plan

🎯 Most Likely: Choppy trading between 6,390-6,425

📊 Watch Volume: Big moves need big volume to stick

⏰ Key Times: 8:30 AM (economic data), 10:30 AM (Fed speakers)

Grandma’s Three Paths (Pick One!)

🔴 Path #1: Down We Go (45% chance)

- Where: Drop to 6,350 area

- Why: Big money positioned for selling, market wants to test lower levels

- Trigger: Break below 6,390

🟡 Path #2: Magnet Pull (35% chance)

- Where: Pulled up to 6,425 area

- Why: That’s where most options expire worthless (Max Pain)

- Range: Bounce between 6,400-6,425

🟢 Path #3: Surprise Rally (20% chance)

- Where: Push above 6,440

- Why: Good news surprises everyone

- Needs: Strong economic data or dovish Fed talk

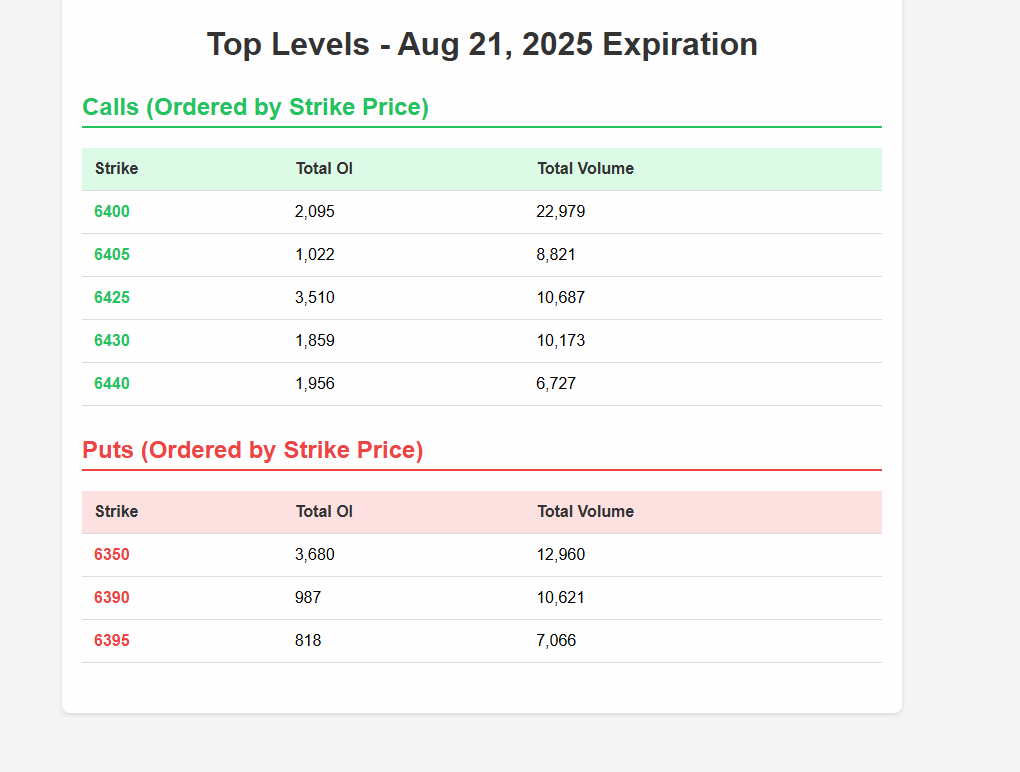

Key Levels (The Important Numbers)

🛑 SUPPORT (Where buying might come in):

- 6,400 – Huge volume here (22,979 contracts!)

- 6,390 – Last stand before bigger drop

- 6,350 – Major target if we fall

⚠️ RESISTANCE (Where selling might happen):

- 6,425 – The magnet level (Max Pain)

- 6,430 – Breakout point

- 6,440 – Rally target

Calls vs Puts Scorecard

📞 CALLS (Betting on UP moves)

Top Strikes Where Bulls Are Playing:

- 6,425 – 10,687 contracts (Max Pain level)

- 6,430 – 10,173 contracts (breakout bet)

- 6,440 – 6,727 contracts (rally target)

What This Means: Bulls want to push above 6,425 to make money

📉 PUTS (Betting on DOWN moves)

Top Strikes Where Bears Are Playing:

- 6,400 – 22,979 contracts (MASSIVE volume!)

- 6,390 – 10,621 contracts (breakdown level)

- 6,350 – 12,960 contracts (big drop target)

What This Means: Bears are loaded up and ready to sell

Grandma’s Simple Translation

“Honey, imagine the market is a ball sitting on a hill. There are three paths it can roll down:”

- Left path (DOWN): Steep hill to 6,350 – once it starts rolling, gravity takes over

- Middle path (FLAT): Stays near 6,400-6,425 – like a ball in a bowl, keeps bouncing back

- Right path (UP): Has to roll uphill to 6,440 – needs a big push to make it

“The problem today is there are MORE people pushing the ball left (puts) than right (calls). Plus, the ball moves faster than normal when it gets going.”

What To Watch For

📺 Economic Calendar:

- Jobless Claims (forecast: 230K)

- Home Sales data

- Jackson Hole Fed meeting begins

- Fed speakers throughout day

🚨 SPX Levels to Watch:

- Below 6,390: Bears take control

- Above 6,430: Bulls fight back

- At 6,425: Tug of war continues

Today’s Game Plan

🎯 Most Likely: Choppy trading between 6,390-6,425

📊 Watch Volume: Big moves need big volume to stick

⏰ Key Times: 8:30 AM (economic data), 10:30 AM (Fed speakers)

Risk Warning (The Fine Print)

- Today’s market moves faster than normal

- Small position sizes recommended

- Jackson Hole could change everything quickly

- Don’t fight the major levels – respect them

Grandma’s Bottom Line: “It’s like driving in fog – slow down, watch the road signs (key levels), and be ready to change direction quickly!”

Coffee With Q – Making markets simple since always

📧 Questions? Comments

Disclaimer: This content is for educational purposes only. Trading involves risk and past performance does not guarantee future results. Always consult with qualified financial professionals before making investment decisions.

Trading Involves Risk

Trading financial instruments, including but not limited to stocks, options, futures, and cryptocurrencies, involves a high degree of risk and is not suitable for every investor. You should carefully consider whether trading is appropriate for your financial situation. Only risk capital should be used when trading.

Q Factor is a software tool designed to assist traders in analyzing market data, developing strategies, and managing trading decisions. It is not a trading signal service, brokerage, advisory service, or educational course. Q Factor does not execute trades on your behalf, provide individualized investment advice, or guarantee any trading results.

All outputs generated by Q Factor—such as indicators, analytics, strategy suggestions, or performance reports—are for informational and research purposes only and should not be construed as investment advice. The accuracy, completeness, and timeliness of data or analysis generated by Q Factor are not guaranteed. Any trading decisions you make based on information from Q Factor are made entirely at your own risk.

You are solely responsible for assessing the potential risks and consequences of your trading activities. Past performance, whether simulated or historical, is not necessarily indicative of future results.

Market Opinions Are Not Investment Advice

Any market commentary, forecasts, backtesting results, or strategy ideas generated or displayed by Q Factor are general market opinions and not specific investment recommendations. We accept no liability for any loss or damage, including but not limited to loss of capital or profit, that may arise directly or indirectly from the use of Q Factor or reliance on its outputs.

Technology & Internet Risks

Trading with the assistance of internet-connected software carries inherent risks, including but not limited to:

- Hardware or software failures

- Internet connectivity issues

- Data transmission delays

- System compatibility problems

Q Factor and its developers cannot control third-party data feeds, signal strength, or internet reliability, and therefore accept no responsibility for communication failures, errors, or delays in market data delivery.

U.S. Government Required Disclaimer – CFTC Rule 4.41

Futures and options trading has large potential rewards but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Do not trade with money you cannot afford to lose. This software is neither a solicitation nor an offer to buy/sell futures, options, or any financial instruments. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Hypothetical or Simulated Performance Disclaimer:

“HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. In fact, there are often sharp differences between hypothetical performance results and the actual results subsequently achieved by any trading program.”

Factors such as market volatility, emotional discipline, slippage, and order execution can significantly impact real trading results and cannot be fully accounted for in simulated performance.

This report is generated by Q Factor proprietary algorithms for informational purposes only. All analysis represents algorithmic processing of market data and should not be construed as investment advice. Users are responsible for their own trading decisions and risk management.

Information may contain errors or omissions; users must independently verify all data and assume full responsibility for trading decisions – Q Factor disclaims liability for any inaccuracies or resulting losses.