By Q | July 12, 2025

If you’ve scrolled through Crypto Twitter or sat through yet another “XRP to $10,000” YouTube video, you’ve probably heard this line:

“XRP is ISO 20022 compliant — banks will be forced to use it.“

🛑 Let’s pump the brakes on that hype train.

Because the reality is more nuanced — and way more important if you’re trading with your head and not your hopium. This post clears the fog around ISO 20022, explains XRP’s actual role, and breaks down which coins are truly “ISO 20022 friendly” — and what that even means.

Wait — What is ISO 20022 Anyway?

ISO 20022 is a global standard for financial messaging — not a crypto protocol. It’s like the email format for banks, letting payment systems “speak the same language” across countries, banks, and systems.

It’s what powers SWIFT’s next-gen upgrade, what CBDCs will lean on, and what nearly every global bank is being forced to implement by 2025.

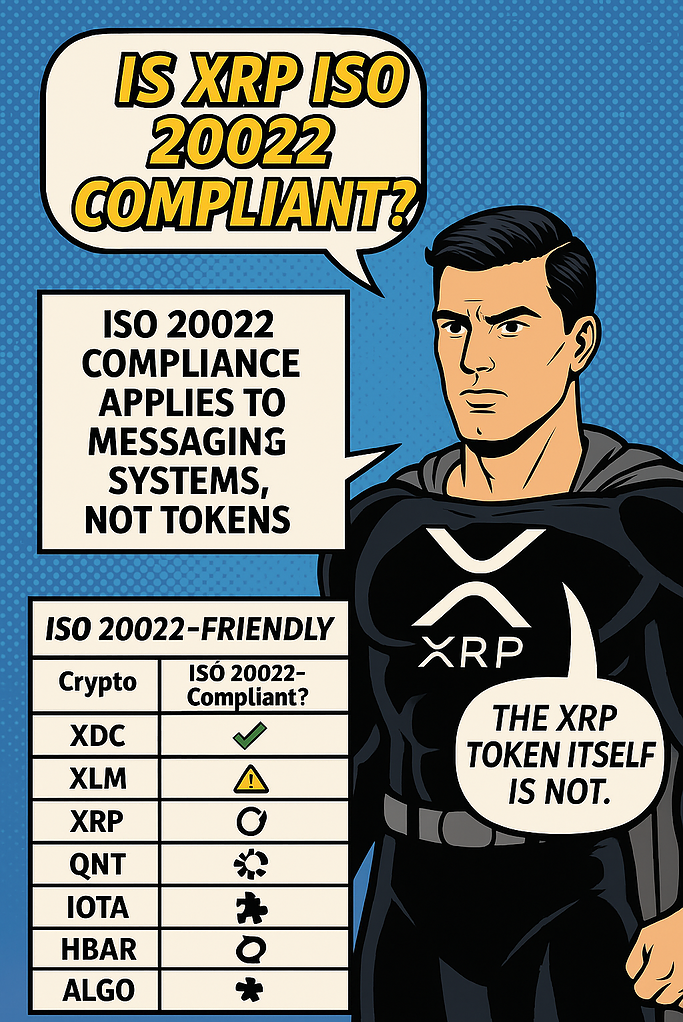

But here’s the kicker: ISO 20022 compliance applies to messaging systems, not tokens. So the question becomes…

Is XRP ISO 20022 Compliant?

Short answer: No.

Slightly longer answer: Kind of, but not how you’ve been told.

✅ What’s True:

- Ripple, the company behind XRP, is part of the ISO 20022 standards body.

- RippleNet, Ripple’s enterprise payment infrastructure, is ISO 20022-compliant.

- XRP is used within that system as a bridge asset for On-Demand Liquidity.

❌ What’s Not True:

- The XRP token itself is not ISO 20022-certified — because tokens don’t get “certified” under ISO protocols.

That’s like saying gasoline is “street legal” because the car that runs on it is.

So… What Does “ISO 20022 Friendly” Mean?

This is where a lot of people get it twisted.

“ISO 20022 friendly” refers to crypto platforms, networks, or systems that are built to work with ISO 20022 messaging standards — not the coins themselves.

Here’s what makes a network ISO 20022 friendly:

- ✅ Its infrastructure (wallets, APIs, messaging layers) can speak ISO 20022’s language.

- ✅ It’s built to interoperate with banks, CBDCs, and SWIFT rails.

- ✅ It’s aiming for financial-grade interoperability, not just DeFi hype.

In other words, they’re playing in the sandbox that banks are about to dominate.

Coin-by-Coin Clarity: ISO 20022 Compliant vs. Friendly

Here’s your no-nonsense breakdown of which cryptos actually matter in this conversation — and why.

| Crypto | ISO 20022-Compliant? | Why It’s “Friendly” |

| XDC | ✅ Yes | Messaging layer is ISO 20022-compliant |

| XLM | ✅ Yes (via Stellar) | Integrates with ISO systems through Stellar Foundation |

| XRP | ⚠️ Partially | RippleNet is compliant; XRP is used within it |

| QNT | ✅ Yes (Overledger) | Bridges legacy financial systems to ISO 20022 networks |

| IOTA | 🔄 In Progress | Building ISO messaging integration for IoT payments |

| HBAR | 🧩 Compatible | Enterprise-grade DLT with ISO-aligned architecture |

| ALGO | 🧩 Not Certified | Supports CBDC pilots and financial-grade applications |

🧠 TL;DR: What Traders Need to Know

- XRP is not ISO 20022 compliant. RippleNet is.

- Tokens don’t get certified under ISO 20022 — only systems do.

- “ISO 20022 friendly” means a crypto network is built to plug into ISO-compliant banking rails — it does not mean the token is destined for mass adoption just because of that.

✅ The strong ISO-aligned contenders:

- XDC

- Quant (QNT)

- Stellar (XLM)

🚧 On the way:

- IOTA, HBAR, and Algorand — all making moves to support messaging interoperability, especially in CBDCs and enterprise use.

📣 Final Word from Q

ISO 20022 is real. It matters. It’s a core upgrade to the future of global money movement. But don’t fall for the narrative that it’s a magic price catalyst.

🚫 There’s no button that gets pressed in a central bank that forces them to buy XRP.

✅ Instead, follow adoption. Follow utility. Follow the real rails being built beneath the noise.

And as always:

Trade facts, not fantasy. Stack logic, not hopium.

☕ Stay sharp — and stay tuned.