Learn how to understand fair value gaps and trade the right gap with an edge with IKIGAI Masterclass.

If you’ve ever looked at a price chart and noticed a space where the candles don’t connect, you’ve spotted a gap. Most traders scroll right past them. But understanding what gaps actually mean—and why they tend to get “filled”—can give you a real edge.

Let me break it down in plain English.

What Is a Price Gap?

A gap happens when price jumps from one level to another without trading in between. Imagine you’re watching a stock close at $100. The next morning, it opens at $103. That $3 space? That’s a gap.

On a chart, it looks like a hole—a place where no candles exist.

Gaps happen for a few reasons: overnight news, earnings surprises, economic data releases, or simply a rush of buying or selling when the market opens.

Why Do Gaps Get Filled?

Here’s the interesting part: price has a tendency to come back and “fill” these gaps. Not always, but often enough that traders pay attention.

Think of it like this. When price gaps up, it skipped over a zone where buyers and sellers never got to do business. There’s unfinished business there. Traders who missed the move want in. Others want to take profits. That pull tends to draw price back to fill the hole.

The same works in reverse. If price gaps down, it often bounces back up to fill that space before continuing lower.

Two Types of Gaps You Should Know

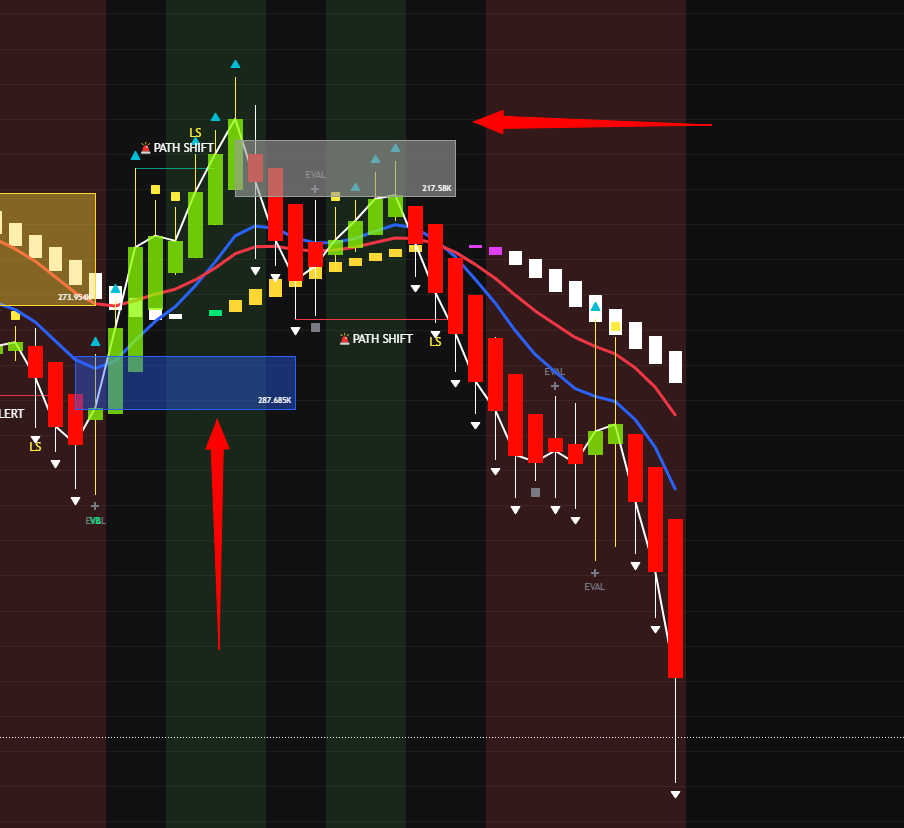

Bullish Gaps (Gap Up) Price opens higher than the previous candle’s high. This creates a gap below current price. When price eventually drops back down to touch that gap level, traders often look for a bounce—a potential buying opportunity.

Bearish Gaps (Gap Down) Price opens lower than the previous candle’s low. This creates a gap above current price. When price rallies back up to that gap level, traders watch for rejection—a potential shorting opportunity.

How Traders Actually Use This

The strategy is straightforward:

- Identify the gap — Mark where price jumped and left a hole

- Wait for price to return — Be patient; it might take hours or days

- Watch for a reaction — When price reaches the gap, does it bounce or blast through?

- Make your decision — A bounce at a bullish gap could mean long. A rejection at a bearish gap could mean short.

The key word is “reaction.” You’re not blindly buying or selling at the gap. You’re watching to see how price behaves when it gets there.

A Few Things to Keep in Mind

Not every gap gets filled. Sometimes price gaps and just keeps running. That’s why gap trading works best as one tool among many—not a standalone strategy.

Also, the size of the gap matters. Tiny gaps happen constantly and might not mean much. Larger gaps, especially on higher volume, tend to act as stronger magnets.

And timing matters too. A gap from this morning carries more weight than one from three weeks ago.

The Bottom Line

Gaps are simply places where price moved too fast and left a hole behind. Markets don’t like holes. They tend to fill them.

Understanding this gives you a framework: watch for gaps, mark them on your chart, and pay attention when price comes back to visit. You might be surprised how often these levels produce a tradeable reaction.

It’s not magic. It’s just how markets work.

Ready to Spot Gaps Like a Pro?

Understanding gaps is just the beginning. In the IKIGAI Masterclass, I teach you exactly how to detect these setups in real-time, read smart money traps before they spring, and turn this knowledge into consistent trading opportunities.

This isn’t theory. It’s the same framework I use every single day.

Become a Gap Detector → Join the IKIGAI Masterclass

Learn to see what most traders miss.